2015 has been a tremendous year of change as employers continue to grapple with rising health insurance costs and increasing complexities with the Affordable Care Act. Many employers continue to cost shift their health insurance programs through plan design changes, increasing employee contributions, increasing cost share for prescription drug benefits, and offering high deductible health plans. An increasing number of employers are beginning to review their options should the impending Cadillac Tax come to fruition in 2018. And while many companies offer wellness programs to their employee workforce, very few have transitioned to health management programs.

As most large companies have renewed their plans for 2016 at a range between 3 – 8.5% after plan modifications, mid-sized companies are being offered incentives to renew their plans early with October to December 1st renewal dates. These offers have generally ranged from 3% to 12% and provide the mid-sized employer the opportunity to escape the flurry of activity that is associated with a year-end open enrollment process. Some insurance carriers have gone so far as to offer 13-15 month rate guarantees on top of the renewals. The benefit of taking the early renewal offer is that it allows the plan to continue having composite rating one more year (for companies that have between 51-100 employees) and avoids the administrative rush that occurs for January 1 renewals.

Some of the increased administrative activity we are seeing in the marketplace has been due to the change in definition of a small group. Up until now, small groups were defined by an employee count of between 2 to 50. Groups with over 50 employees were considered mid-sized or large. With the ACA, small groups will be defined as a company with 2 to 100 employees. The plans offered in this marketplace are based on the ACA metal tiering system, are very cookie-cutter (no customization), and the rates are based on each individual’s age. Not all states are required to make this modification but we do see this happening in the next few years.

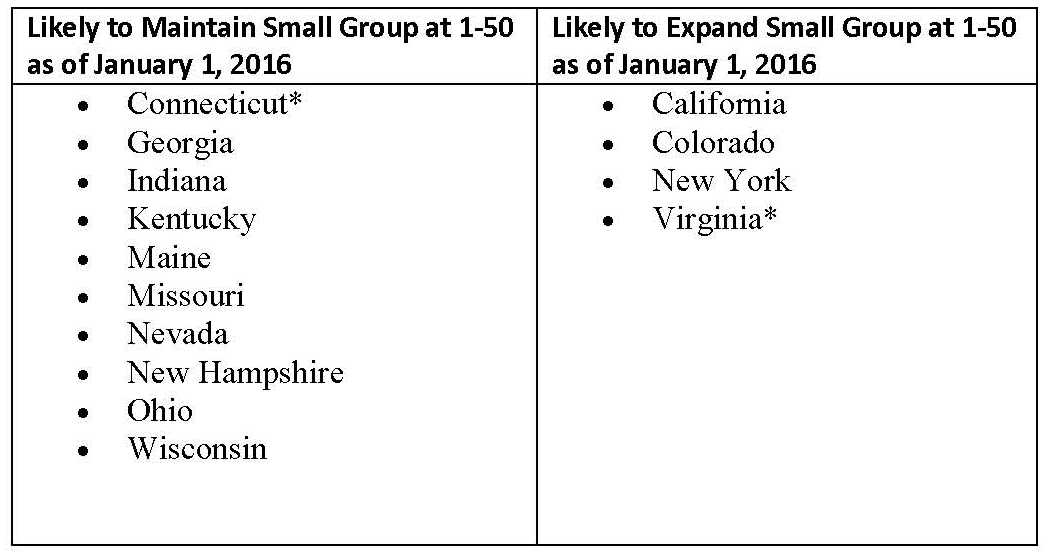

The chart below shows the states we believe will expand their small group markets to 1-100 on January 1, 2016 and those who will maintain their small group market definition at 1-50:

*This includes Virginia. Efforts are underway in that state to propose legislation that would retain small group at 1-50, but even if successful, would not pass until February 2016 at the earliest. Connecticut also amended its law to expand the small group market, but reserved discretion to the state’s insurance commissioner to maintain small group at 1-50. Connecticut’s Insurance Department has indicated that it will maintain the state’s small group market at 1-50.

The small group market place will be quite the spectacle as renewals will come in between 10% and 100%. Plans that have the higher renewals are usually going to be those who have been grandmothered for the last year, have had a low RAF (Risk Adjustment Factor), have a younger workforce, and are converting to ACA compliant benefit levels.

2016 poses to be an interesting year because of the upcoming presidential elections. Healthcare and/or health insurance reform is going to be a key talking-point, especially with costs continuing to rise and the impending 40% non-deductible Cadillac Tax in 2018. Both unions and businesses are generally against the Cadillac Tax but the ACA reforms will depend on revenue generated from it. Employees generally have to pay more both in premium contributions as well as out-of-pocket expenses whether in the form of deductibles or copayments. Various surveys point to insurance renewals around the 6 – 8.5% range. But both technological advancements in medicine and specialty drug medications are going to continue pushing health cost trend upwards.

Having reviewed many renewals and surveys, health insurance renewals will most likely hold to the 6 – 8.5% range. Healthcare trend has been at a low for the past few years and it is only a matter of time before they head towards double digits again. There is simply no limit to what our current health-economic model can place on health and life. We as Americans believe in an economic system where there is a high value placed on life. And we provide the means by which people can pay to continue living.

Some of the solutions that have been discussed at different levels of industry and academia include:

• Providing incentives to choose lower cost options

• Adoption of virtual care centers

• Create a system where providers compete based on customer satisfaction and outcomes

• Employer engagement with managing the health of the workforce

At UBF, we believe that these solutions are effective and our most enlightened clients have adopted these measures into their long term strategic planning. But these solutions are not for the faint of heart. What is needed is radical change. But radical change requires courage and a radical change of thinking. We invite you to speak with us about how your plans can be transformed so that you don’t get on the other side of the trend curve.

Alan Wang is the President of UBF and serves as the lead consultant. He has delivered the UBF solution set throughout the world and is highly regarded for his areas of expertise. You can follow him on Twitter @UBFconsulting.